Programme

| Time | Session | Location |

|---|---|---|

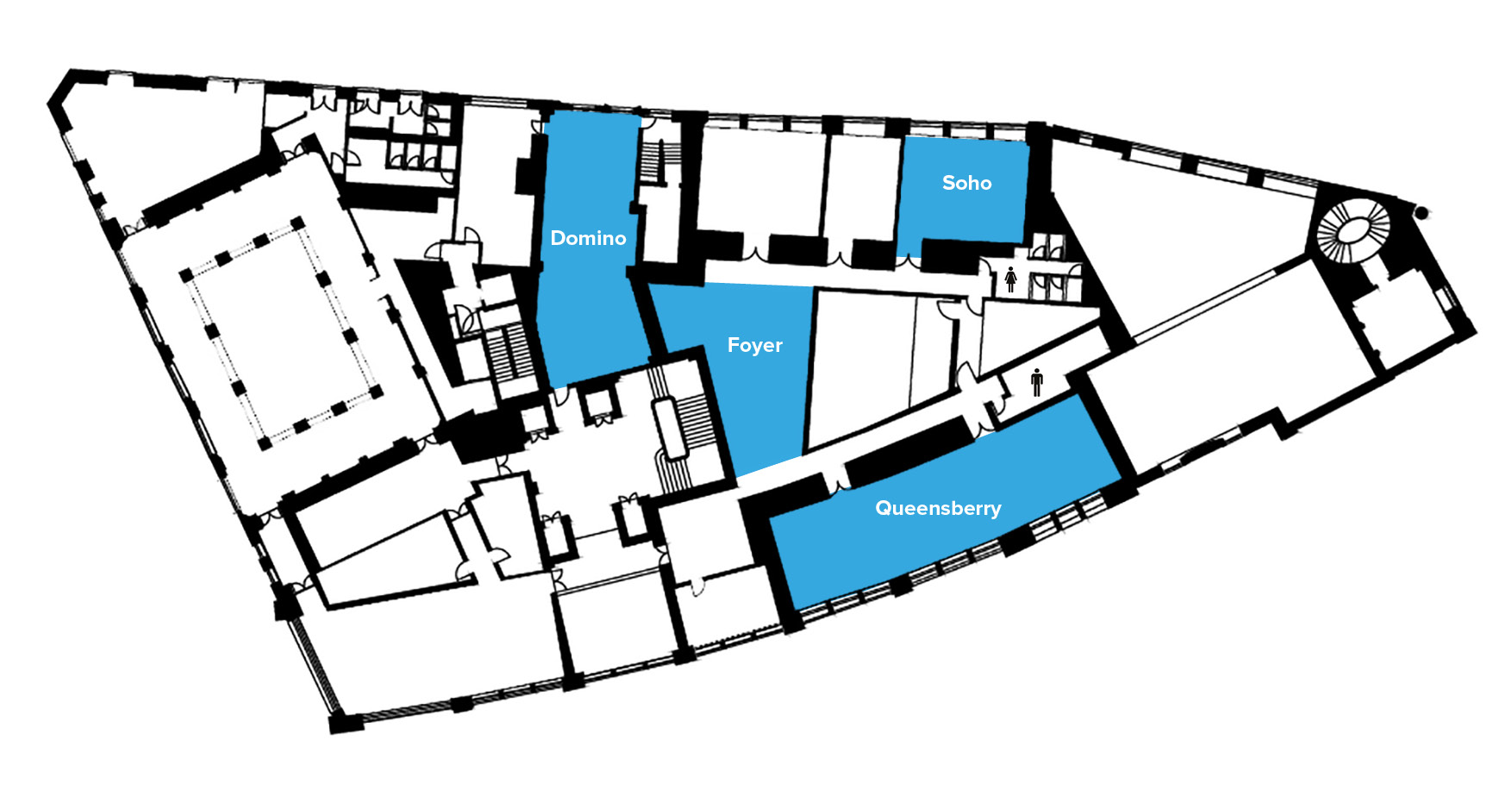

| 08:30 - 09:00 | Registration | Foyer → |

| 09:00 - 09:45 | Welcome & Keynote Address → | Queensberry → |

| 09:50 - 10:30 | Session 1 → | Soho → |

| 10:35 - 11:15 | Free | Foyer → |

| 11:15 - 11:45 | Coffee | Foyer → |

| 11:45 - 12:25 | Session 3 → | Soho → |

| 12:25 - 13:05 | Free | Foyer → |

| 13:05 - 14:20 | Lunch → | Queensberry → |

| 14:20 - 15:00 | Session 5 → | Soho → |

| 15:00 - 15:40 | Free | Foyer → |

| 15:40 - 16:10 | Tea | Foyer → |

| 16:10 - 16:50 | Session 7 → | Soho → |

| 16:50 - 17:30 | Free | Foyer → |

| 17:30 | Drinks reception | Domino → |

Keynote and Delegates

- Keynote address

-

Investing in the 21st Century Brain

‘Investment’ in the brain can be viewed in two ways: personal development and professional profit. We all have a personal interest in the brain, since it is the basis of our unique minds. The wonderful thing about being a human being is that although we are born with a full complement of brain cells, it is the growth of connections between the cells that accounts for the growth of the brain after birth. These connections reflect the unique sequence, a life-story, of individual experiences and interactions with the outside world: a phenomenon known as ‘plasticity’ that leads to the personalisation of the physical brain, amounting to a ‘mind’. Given the unprecedented challenges posed by the digital world to thinking, emotions and well-being, we need to devise the best ways for optimising fulfilment of each individual’s potential, as well evaluating the best possible investments arising from digital technologies and AI. The other significant factor for the well being of the 21st Century brain, and indeed in the opportunity for high return investment, is the increase in prevalence of Alzheimer’s Disease. The global market for AD treatment will more than double in value from $4.9 billion in 2013, to reach an estimated $13.3 billion in 2023. However, the challenge is to devise a treatment that tackles not the consequence of neurodegeneration i.e., amyloid plaques, but the actual cause. We shall explore a disruptive approach based on the pivotal mechanism of degeneration, leading to a possible pre-symptomatic lateral flow test for Alzheimer’s as well as a first-in-class therapeutic with proven efficacy in a living animal model. The combination of a presymptomatic screen coupled with an drug treatment that halted cell loss, would amount to an effective ‘cure’. This would surely be a great investment, both on a personal as well as a professional level!

Baroness Susan Greenfield

CBE, FRCP (Hon)

Baroness Greenfield, Founder and CEO of Neuro-Bio Ltd is a neuroscientist, writer and broadcaster. She has published over 200 papers in peer-reviewed journals, based mainly at Oxford University but has held research fellowships at the College de France Paris, NYU Medical Center New York and Melbourne University. She holds 32 honorary degrees from UK and foreign universities, has received numerous honours including the Legion d’Honneur from the French Government, an Honorary Fellowship from the Royal College of Physicians, The American Academy of Achievement Golden Plate Award, and The Australian Medical Research Society Medal. She is also a Fellow of the Royal Society of Edinburgh.

- Session 1

-

Soho

Haig Bathgate

Head of Investment

atomos wealthRichard Larner

Head of Research

Brooks MacdonaldRichard Swain

Head of Funds Research

Bentley ReidNathan Sweeney

Deputy CIO - Multi-Asset

Marlborough Investment ManagementDavid Thornton

Fund Manager

Premier Miton InvestorsRichard Warne

Senior Portfolio Manager

Copia Capital

- Session 3

-

Soho

Robert Burdett

Head of Multi-Manager Solutions

Columbia Threadneedle Multi-ManagerCristina Dondiuc

Research Analyst

Fidelity InternationalDavid Jardine

Head of Portfolio Management

STANLIB Multi-ManagerDarren Morgan

Portfolio Director

Cazenove CapitalMark Richmond-Watson

Portfolio Manager

James Hambro & PartnersMark Shapley

CIO

Alder InvestmentJulia Warrander

Group Director

Affinity Private Wealth

- Lunch

-

Queensberry

Tom Caddick

Managing Director

NedGroup InvestmentsRichard Larner

Head of Research

Brooks MacdonaldMark Preskett

Senior Portfolio Manager

Morningstar

- Session 5

-

Soho

Mireille Bensimon

Investment Analyst

Legal & General Investment ManagementAdam Carruthers

Collectives Analyst

Charles Stanley & CoCameron Falconer

Head of Investment Oversight & Manager Research

Aviva InvestorsIan Goodchild

Investment Director

Mattioli WoodsWee-Tsen Lee

Head of Fund Research

Lockhart Capital ManagementRichard Philbin

Chief Investment Officer (Solutions)

Hawksmoor Investment ManagementMatthew Stanesby

Managing Director

Close Brothers Asset Management

- Session 7

-

Soho

Derek Beatty

Portfolio Manager

Julius BaerTom Caddick

Managing Director

NedGroup InvestmentsTom Jemmett

Head of Authorised Funds

LGT Wealth ManagementJohn Monaghan

Research Director

Square MileMark Preskett

Senior Portfolio Manager

MorningstarAmanda Sillars

Fund Manager, ESG Director: JIF Team

Jupiter Asset Management

Downloads

Information

The Next Generation Forum was devised and organised by Infusion Events. We will be available throughout the event and we will be happy to help with any queries you may have. Please come and find us at the registration desk or phone us on one of the following mobile numbers:

Sally Doyle 07881 957350

Sarah Ford 07702 331487

Wi-Fi

Should you wish to catch up with the office during your breaks, we have arranged a complimentary and secure Wi-Fi connection:

SSID: NGF23*

Password: 23FGN2023

Drinks Reception

A reminder that the Drinks Reception will commence at 17.30 in Domino, which is also on this floor of the hotel. Please refer to the floorplan section or we will be happy to direct you. Dress code remains Business Attire.

Transport

We recommend the following reliable car service: