Programme

| Time | Session | Location |

|---|---|---|

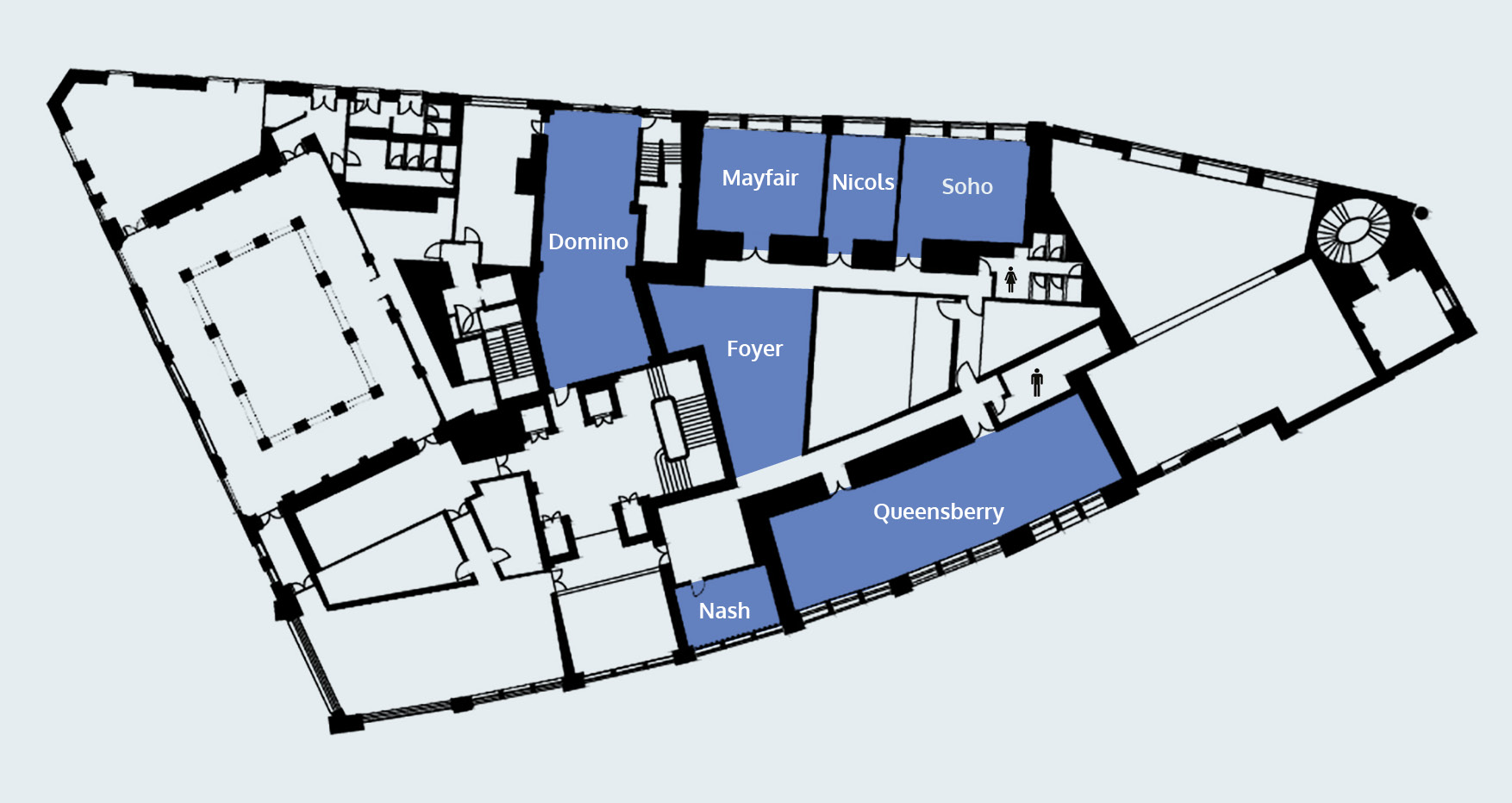

| 08:30 - 09:00 | Registration | Foyer → |

| 09:00 - 09:45 | Welcome & Keynote Address → | The Queensberry → |

| 09:50 - 10:30 | Schroders Capital → | Nicols → |

| 10:35 - 11:15 | M&G Investments → | Nicols → |

| 11:15 - 11:45 | Coffee | Foyer → |

| 11:45 - 12:25 | Barings → | Soho → |

| 12:25 - 13:05 | Janus Henderson Investors → | Soho → |

| 13:05 - 14:20 | Lunch: Janus Henderson Investors | The Queensberry → |

| 14:20 - 15:00 | PIMCO → | Nash → |

| 15:00 - 15:40 | Comgest → | Nash → |

| 15:40 - 16:10 | Tea | Foyer → |

| 16:10 - 16:50 | BlackRock → | Mayfair → |

| 16:50 - 17:30 | Ninety One → | Mayfair → |

| 17:30 | Drinks Reception | Domino → |

Speakers

- Keynote Address

-

Intergenerational Dynamics: The Key Forces Driving the Multigenerational Marketplace

Intergenerational dynamics are reshaping industries worldwide, providing business leaders with challenges and opportunities. This engaging keynote focuses on the two youngest working generations, examining the forces driving these shifts, and the transformative impact they are about to have on businesses. Concluding with practical "killer apps" for immediate application, the session also uncovers the 21st century's most valuable — and often underestimated — commodity.

You may never look at your “mobile” phone in the same light again.

Dr Paul Redmond

Dr Paul Redmond is one of the UK’s leading experts on generational theory, the future of work, and graduate employability. With over 30 years of experience in educational sociology and career development, Paul has developed deep insights into the expectations of HR professionals, the labour market, and young people entering the workforce.

As Director of Student Experience and Enhancement at the University of Liverpool, Paul focuses on preparing graduates for the workplace, addressing generational differences, and enhancing employability. His research spans topics such as millennial expectations, multigenerational workplaces, and the impact of automation on the future of jobs.

A sought-after speaker and author, Paul has written several books, including Talking About My Generation and A Parent’s Guide to Graduate Jobs. He is a regular contributor to media outlets such as The Economist, The Guardian, and The Daily Telegraph, and has appeared on radio and TV, including the BBC documentary Who Gets the Best Jobs?.

Engaging and insightful, Paul provides a fresh perspective on navigating the challenges and opportunities of the evolving workplace.

- Schroders Capital

-

Schroders Capital Global Energy Infrastructure LTAF (OEIC)

Schroders Capital is set to launch the first energy transition focused wealth LTAF in Q1 2025 with a structure specifically designed for advised and discretionary UK retail investors (RMMIs). The launch of this fund will open access to investment themes and risk premia not available in public markets in a structure specifically designed for UK wealth. Join Schroders Greencoat, energy transition specialist, as they discuss new ways to access energy transition infrastructure.

Duncan Hale, Lead PM, will introduce the strategy and discuss the specific opportunities in energy transition infrastructure. Covering investment characteristics and the portfolio benefits as well as the current market dynamic around pricing and deal sourcing. Everything from wind farms to battery storage and green hydrogen.

Duncan Hale

Lead Portfolio Manager

Duncan Hale joined Schroders Greencoat in 2022. He works within the private markets business, with a particular focus on enhancing Schroders Greencoat’s footprint in the Defined Contribution market. He has spent his career helping institutional investors get access to real assets. Prior to Schroders Greencoat, Duncan worked at WTW, where he most recently headed up their secure income assets capability, playing a key role in identifying, investing in, and managing a broad range of cashflow generating real assets for UK and European pension funds. He also assisted in the education and capital raising in these areas. Prior to this, Duncan spent time heading WTW’s global Infrastructure Research team, along with consulting to large DC corporate plans. Duncan holds a BComm (Hons) in Politics and International Relations from the University of Sydney, and is a CFA Charterholder.

Jack Wasserman

Private Markets Group

Jack Wasserman joined Schroders Greencoat in 2022 and is part of Schroders Greencoat's private markets team focusing on fund-raising activities and investor relations with clients in the UK and Asia. Prior to joining Schroders Greencoat, Jack worked as the Investment Director responsible for Impact Strategies at BlueOrchard Finance Ltd, the Swiss private markets Impact Investment specialist within the Schroders Group. There he was responsible for product development and capital raising across Infrastructure, Private Equity, Private Debt and Public Debt impact solutions. He started his investment management career at Schroders in 2011 where he was responsible for UK based clients. Jack is a Chartered Financial Analyst (CFA), holds a BSc in Accounting and Finance from the University of Leeds and the Investment Management Certificate (IMC).

Samantha Gold

Head of London & Wealth

Samantha Gold was appointed Head of London and Wealth within the UK Intermediary Team in 2021 and manages the team responsible for client relationships across the London area. Having joined Schroders in 2000, she has 24 years of industry experience. Over this period, she has held a number of key positions within the UK Intermediary Team, including Head of Broker Liaison, Head of Business Development and Head of Intermediary Business Development, London.

E: samantha.gold@schroders.com

T: +44 (0)7770 496062

Emma Matthews

Sales Director

Emma Matthews is in the UK Wealth Business Development team at Schroders, which involves maintaining relationships and supporting London based discretionary clients. Specifically, wealth managers, multi-managers, family offices and fund of hedge funds. She joined the team in 2014 after two years at Cazenove as an assistant portfolio manager, and prior to her current role, supported sales managers across London discretionary and South Africa.

E: emma.matthews@schroders.com

T: +44 (0)20 7658 1363

- M&G Investments

-

India: a growing allocation for investment portfolios

Vikas Pershad will discuss why he thinks India represents a unique opportunity to invest in one of the world’s most transformative economies. The team believes the country is at a pivotal moment, with its companies leading in innovation, digital transformation, and sustainable practices. The country is also growing in geopolitical importance, while domestically the government is focused on support for the private sector with initiatives like “Make in India”. A growing number of globally competitive tech firms and domestic leaders that are driving modernisation across industries can now be seen. Vikas will go into detail on the fund’s current positioning and how he and the team focus on identifying forward-thinking Indian companies.

Vikas Pershad

Portfolio Manager

Vikas Pershad joined M&G in 2019 as a Fund Manager in the Asia Pacific team, having previously worked for Port Meadow Capital Management. Prior to that, Vikas was a Portfolio Manager in UBS O’Connor, most recently in Hong Kong, and previously Chicago. Before this, Vikas held various fund manager and analyst roles in Veda Investment, Hound Partners, TPG-Axon Capital, and Madison Dearborn Partners, based in Hong Kong and United States. He started his career as an Analyst with Merrill Lynch & Co within the Mergers and Acquisitions Group. Vikas graduated from the University of Virginia with a Bachelor of Arts in 1999 (Echols Scholar). Vikas also holds a Master of Public Policy from Harvard University, Kennedy School of Government.

Paul Faragher

Sales Director, UK Wholesale

Paul Faragher started his career in asset management distribution at Janus Henderson twenty years ago, having graduated from the University of Exeter with a BA Honours degree in Politics. He went on to spend nearly twelve years at BNY Mellon IM, the majority of which was spent as a Regional Investment Director, working with key advisory and discretionary clients across East Anglia and the South East. More recently he enjoyed three years in a senior sales role at Jupiter AM, before joining M&G Investments in April ‘21 as a Sales Director for London. Paul holds the IMC and the CFA Certificate in ESG Investing.

E: paul.faragher@mandg.com

Rupert Wooster

Sales Director, UK Wholesale

Rupert Wooster began his career at Aetna Investment Management in 1991 as broker support assistant, before moving to M&G three years later to join the discretionary sales team. He has performed a number of sales related roles during his 30 years with M&G. Currently, after successfully achieving a demotion in 2019, he is very much in his happy place, as an “on the road” sales person, looking after wealth managers and other discretionary clients largely based in London, and the burgeoning and bustling financial centre which is Winchester.

E: rupert.wooster@mandg.com

- Barings

-

Barings Income Navigator Fund – A comprehensive fixed income solution

The global economy stands at a crossroads, with investors facing uncertainty around growth and inflation amid shifting messaging from the Federal Reserve. To help navigate this landscape, Barings presents the Income Navigator Fund, a comprehensive fixed income solution that combines the best ideas from their global fixed income strategies. The Fund aims to deliver steady income and the potential for capital appreciation. It does this through blending the stability of investment grade corporate credit with the attractive yield potential of high yield credit, while allocations to emerging markets debt and securitised credit provide potential opportunities for higher growth, income and diversification. The Portfolio Management team is also backed by a robust and experienced credit research division.

This multi-faceted and dynamic investment approach enables the team to adapt to shifting market conditions, making this strategy a compelling choice for investors seeking both income generation and portfolio diversification in a single, integrated fixed income solution.

Stephen Ehrenberg

Managing Director, Investment Grade Fixed Income Group

Stephen Ehrenberg is a Portfolio Manager for Barings’ Investment Grade Fixed Income Group. Steve has worked in the industry since 2002, and his experience has encompassed portfolio management and credit analysis for both investment grade and high yield corporate credit. Prior to joining the firm in 2004, he worked in capital markets at MassMutual as part of the firm’s executive development program. Steve holds a B.S. in Mechanical Engineering from the United States Military Academy at West Point (Phi Beta Kappa), an M.B.A. from the University of Michigan Business School (High Distinction) and is a member of the CFA Institute.

Simon Jagger

Managing Director, Head of UK Wealth

Simon Jagger is a member of Barings’ Global Business Development Group. Simon is responsible for the firm’s business development in the UK Wealth market and has worked in the industry since 1994. Prior to re-joining the firm in 2016, he worked for Schroders for 20 years in various sales roles in Guernsey, London and Singapore. Before that he worked for Barings in Guernsey for two years as a private client portfolio manager. Simon graduated from the Aberystwyth University with a degree in international politics and international history. He also served as an Infantry Officer in the British Army. He was awarded the IMC certificate in 1998.

Carl Wilmore

Senior Director, UK Wealth Sales

Carl Wilmore is a member of Barings’ Global Business Development Group. Carl is responsible for the firm’s business development in the UK Wealth market, looking after the firm’s relationships with national wealth managers, family offices and London-based clients for both public and private market capabilities. He has been with the firm for over 16 years. He began in the industry as an investment manager with HSBC Private clients, working as part of a small team responsible for setting the investment strategy across private clients' portfolios. He then joined Credit Suisse as a sales manager for the South of England covering a broad client type.

E: carl.wilmore@barings.com

T: +44 (0)20 7214 1227

- Janus Henderson Investors

-

Global Small Cap: a sea of opportunity

In their presentation, Janus Henderson Investors will be highlighting the opportunity set for Global Smaller Companies whilst using a unique approach to idea generation, stock selection and portfolio construction, that maximises the local knowledge they possess across key geographical small cap regions.

Nick Sheridan

Portfolio Manager

Nick Sheridan is a Portfolio Manager on the Global Smaller Companies and European Equities Teams at Janus Henderson Investors, a position he has held since 2009. Nick joined Henderson in 2009 as part of the acquisition of New Star, where he was a portfolio manager for two years. Before New Star, he was a director of European equities at Tilney for six years. He began his fund management career at BWD Rensburg in 1990 and entered the industry as a buy-side analyst at Ashton Tod McLaren in 1986. Nick graduated with a BA degree (Hons) in politics from Liverpool University. He received the Securities Institute Diploma from the Chartered Institute for Securities & Investment and has 38 years of financial industry experience.

Matthew Frost

Director, UK Client Group

Matthew Frost is Director, London Discretionary Sales at Janus Henderson Investors, a position he has held since 2019. He joined as associate director, sales as part of the firm’s acquisition of Gartmore in 2011. In his current role, Matthew is responsible for discretionary and advisory client relationships in the London region. He joined Gartmore in 2000 and worked in a number of roles with the UK retail sales team before being promoted to discretionary account director in 2010. Matthew began his career with Westpac in 1990. Matthew has 33 years of financial industry experience.

E: matthew.frost@janushenderson.com

M: +44 (0)7946 182038

David Watts

Associate Director

David Watts is an Associate Director on the UK Retail Sales team for Janus Henderson Investors. David joined Henderson’s client services team in 2004 and assumed his current position in 2008. He is responsible for discretionary and advisory client relationships in the London and Southern England sales regions. David holds the Investment Management Certificate (IMC) and has 19 years of financial industry.

E: david.watts@janushenderson.com

M: +44 (0)7714 415245

- PIMCO

-

Big flex, small fund

Navigate today's volatile markets with PIMCO’s Credit Opportunities Bond Fund. When uncertainty is high and credit spreads are tight, a truly active approach can craft a portfolio that is guided entirely by valuations and fundamentals, rather than benchmarks. That is when COB’s dynamic, benchmark-agnostic strategy thrives, boosting the flexibility of your credit exposures. A hidden gem within PIMCO’s lineup, the COB fund harnesses the best ideas across credit desks, with the freedom to express high-conviction trade ideas across investment grade, high yield, securitized credit, bank loans and select emerging markets. In credit, COB is your agile ally for uncertain times.

Charles Watford

Portfolio Manager

Charles Watford is an executive vice president and portfolio manager in the London office, focusing on high yield and multi-sector credit opportunities. He is a member of the diversified income, high yield, and credit research teams. Prior to joining PIMCO in 2007, Charles was a management consultant at McKinsey & Company and an investment banking analyst at Morgan Stanley. He has 21 years of investment experience and holds an MBA from the Wharton School of the University of Pennsylvania. He also holds a master's degree in chemistry from the University of Oxford.

Terry Oh

Head of UK Wealth Management

Terry Oh is an executive vice president and head of PIMCO’s global wealth management business in the UK. Previously he led the global wealth management business for Middle East and Africa (MEA). Over his PIMCO career, he has also worked closely with sovereign wealth funds (SWFs) as well as other institutional investors and multinational banks in EMEA.

E: terry.oh@uk.pimco.com

T: +44 (0)20 3640 1433

Leo Maduro-Vollmer

Account Manager, UK Wealth Management

Leo Maduro-Vollmer is an account manager on the global wealth management team in the London office, focusing on UK financial intermediaries. Prior to joining PIMCO in 2020, he co-founded a financial technology company in London, partnering with Fortune 500 companies and government entities to improve supply chain technologies.

- Comgest

-

What Doesn’t Change In A Fast Changing World

Within Comgest’s recently launched Europe ex UK Compounders Fund they seek companies that have consistent qualities; longevity, durability and visibility of their growth. Key characteristics that make excellent compounding stocks that can stand the test of time. These high-quality companies are typically global industry leaders who, despite financial, economic and geopolitical crises, continue to innovate, expand and achieve earnings growth, while staying true to their cultural values and long-term vision. Franz Weis, CIO and Portfolio Manager, will highlight the key elements of the strategy's investment approach, as well as some stock examples, demonstrating what makes a successful compounder.

Franz Weis

CIO, Portfolio Manager & Managing Director

Franz Weis joined Comgest in 2005 and is a Portfolio Manager specialising in European equities. In addition to being the Group’s Chief Investment Officer (CIO), he is Managing Director of Comgest Global Investors as well as a member of the Group’s Board of Partners and Executive Committee. Franz leads the firm's European research efforts and co-leads the management of the majority of Comgest’s European equity strategies. In his role as CIO, Franz oversees the firm’s investment teams and chairs the Investment Committee, which is responsible for applying Comgest’s philosophy on successful long-term investing. He started his career in 1990 at Baillie Gifford & Co. where he worked as a Portfolio Manager before joining F&C Asset Management as a Senior Portfolio Manager and Director of European Equities in 1996. Franz graduated from Heriot-Watt University (Scotland) with a Master’s degree in International Banking and Financial Studies and received the International Bankers in Scotland Prize in 1990.

Hannah Rosley

Investor Relations

Hannah Rosley joined Comgest in June 2021 and is responsible for promoting Comgest’s fund range to the UK Discretionary market. Prior to joining Comgest, Hannah worked at Federated Hermes, Legal and General Investment Management and EFG Private Bank. Hannah passed the CISI Private Client Investment Advice & Management (PCIAM) with Distinction and holds a BA (Hons) in European Politics and French and the CFA Certificate in ESG Investing.

E: hrosley@comgest.com

M: +44 (0)7786 691831

Tom Culhane

Investor Relations

Tom Culhane has eleven years of experience in the financial industry having worked at BMO Global Asset Management, T. Rowe Price and Impax Asset Management. He holds a MSc in Business & Management as well as an BA in Business Enterprise Development, both from the University of Portsmouth. Additionally, Tom holds the Investment Management Certificate and the CFA Certificate in ESG investing.

E: tculhane@comgest.com

M: +44 (0)7817 296522

- BlackRock

-

How to generate alpha in Asia through exposure to AI

Learn about AI as an investment, an investment tool, and as an investor, from those who have been using it for over a decade. BlackRock will give a live demo of their tools during an engaging session, highlighting the exciting opportunity presented by this technology. Senior PM, Tom Morris will lead the session and show how they have delivered strong and consistent returns through a very volatile time in Asia.

Tom Morris

Managing Director

Tom Morris is a senior member of BlackRock's Systematic Active Equity Investment Group. Tom is responsible for portfolio management and research for a number of the firm’s flagship hedge fund strategies. Before joining BlackRock in 2010, Tom was Head of Quantitative Research for Marble Bar Asset Management in London, where he founded the quantitative investment team and managed "mid horizon" portfolios in Europe, North America and Asia Pac from 2005. Prior to this Tom was a Quantitative Analyst and Investment Strategist with responsibility for developing systematic investment models within the Global Equity Strategy team at Deutsche Bank. Tom has a BSc in Industrial Economics from the University of Warwick in 2002.

Rohan Stewart

Managing Director, Head of UK Wealth Sales

Rohan Stewart, Managing Director, is Head of the UK Wealth and Asset Management Sales Teams within BlackRock's European Business, as well as Head of UK Investment Companies Distribution. Rohan is responsible for the overall strategy and growth for these teams, ensuring that BlackRock's range of investment and technology solutions, in both private and public markets are delivered to the firms wealth clients in the UK. Rohan is also responsible for the growth and fiduciary management of the investment companies business.

Prior to this role, Rohan held a number of roles within the organisation including: Head of Banks in UK Wealth, and Head of wealth distribution for Southern Africa. He is a member of the UK ExCo, Africa ExCo and Co-Head of the European Wealth Leadership Team. Rohan started his career at the BlackRock's predecessor firm, Merrill Lynch in 2004. He holds a BA, joint honours degree from the University of Bristol.

Rohan is a trustee of the charitable organisation Kith and Kids, a London based charity which provides activities, opportunities, information and support for people with a learning disability or autism.

E: rohan.stewart@blackrock.com

Nathan Henry

Vice President, UK Wealth Sales

Nathan Henry is a member of the UK Wealth Sales team, covering fund selectors within our largest Private Bank and Wealth Management accounts. Nathan is responsible for the distribution of BlackRock products, across Active, Passive and Private Market solutions.

E: nathan.henry@blackrock.com

T: +44 (0)20 7743 2084

- Ninety One

-

Investing in the next generation of EM business leaders

Emerging markets are in rapid flux as the development gaps to advanced economies shrink. As these countries transform, the dominant corporations of today will be swept aside by a new generation of business leaders.

The Ninety One Emerging Markets Leaders strategy invests in companies that not only represent the future of emerging markets, but are helping to create it.

The investment team focuses on sustainable businesses targeting the outsized growth potential of parts of emerging economies that are currently deeply underserved, but that are beginning to flourish as incomes rise.

Portfolio manager Juliana Hansveden will discuss where the next generation of EM leaders are likely to be found; how they are propelling emerging economies into a brighter future via the provision of modern healthcare, energy, financial and digital services, and more; and why a sustainable ‘EM Leaders’ investment approach can unlock differentiated alpha opportunities and result in a distinctive emerging markets equity portfolio.

Juliana Hansveden

Portfolio Manager

Juliana Hansveden is a portfolio manager in the Sustainable Equity team at Ninety One. Prior to joining the firm, Juliana was the lead portfolio manager of the multi-billion euro Emerging Stars and the Asian Stars equity strategies at Nordea Asset Management. Before this Juliana held roles with First Swedish National Pension Fund (AP1) as a global equity analyst and assistant portfolio manager, and at BlackRock analysing European equities before becoming an associate and covering Asia ex-Japan equities in the Global Emerging Markets Equity team. Juliana has a Master of Science in Economics & Business from Stockholm School of Economics and has also studied at Ecole des Hautes Etudes Commerciales de Paris (HEC Paris). She is a CFA® Charterholder.

Wil Jeffs

Head of UK Wealth

William (Wil) Jeffs is Head of the UK Wealth team at Ninety One. He is responsible for assisting the distribution of Ninety One funds to discretionary wealth managers, multi manager and private banks in London. Prior to joining Ninety One, Wil began his career in 2010 as an investment manager at Brewin Dolphin where he looked after discretionary portfolios for high net worth individuals. Wil has passed his CISI Level 7 Chartered Wealth Manager qualification and also holds the CISI Diploma in Investment Advice (IAD).

E: william.jeffs@ninetyone.com

T: +44 (0)20 3938 2702

Nicole Hodges

Sales Manager

Nicole Hodges is a sales manager within the London wealth team in the UK Client Group. She is responsible for assisting the distribution of our funds to discretionary wealth managers, multi manager and private banks in London and in the Channel Islands. Prior to this, she was a senior client executive at Arlingclose Ltd where she was responsible for maintaining and supporting client relationships. The role also included fund analysis, offering investment advice and pitching for new mandates. Nicole graduated from the University of Leeds with a BA Hons degree in Economics and Politics in 2016. She holds Unit 1 of the Certificate in Investment Management (IMC); CISI Certificate in Securities and the CISI Diploma in Investment Advice (IAD).

Downloads

Information

The Next Generation Forum was devised and organised by Infusion Events. We will be available throughout the event and we will be happy to help with any queries you may have. Please come and find us at the registration desk or phone us on one of the following mobile numbers:

Sally Doyle 07881 957350

Sarah Ford 07702 331487

Wi-Fi

Should you wish to catch up with the office during your breaks, we have arranged a complimentary and secure Wi-Fi connection.

To access the secure connection, please locate ‘NGF25’ and use the password: 52FGN2025

Drinks Reception

A reminder that the Drinks Reception will commence at 17:30 in Domino, which is also on this floor of the hotel. Please refer to the floorplan section or we will be happy to direct you. Dress code remains Business Attire.

Transport

We recommend the following reliable car service: