Programme

| Time | Session | Location |

|---|---|---|

| 08:30 - 08:50 | Registration | Secret Garden → |

| 08:50 - 09:30 | Keynote Address → | Purdey → |

| 09:30 - 10:10 | Robeco → | Solo → |

| 10:10 - 10:50 | PGIM Investments → | Solo → |

| 10:50 - 11:10 | Coffee | Secret Garden → |

| 11:10 - 11:50 | DoubleLine → | Peel → |

| 11:50 - 12:30 | Brown Advisory → | Peel → |

| 12:30 - 13:20 | Lunch | Secret Garden → |

| 13:20 - 14:00 | Pictet Asset Management → | Kuryakin → |

| 14:00 - 14:40 | Allianz Global Investors → | Kuryakin → |

| 14:40 - 15:00 | Tea | Secret Garden → |

| 15:00 - 15:40 | First Eagle Investments → | Steed → |

| 15:40 - 16:20 | Coronation Fund Managers → | Steed → |

| 16:20 - 17:00 | Drinks Reception | Secret Garden → |

Speakers

- Keynote speaker

-

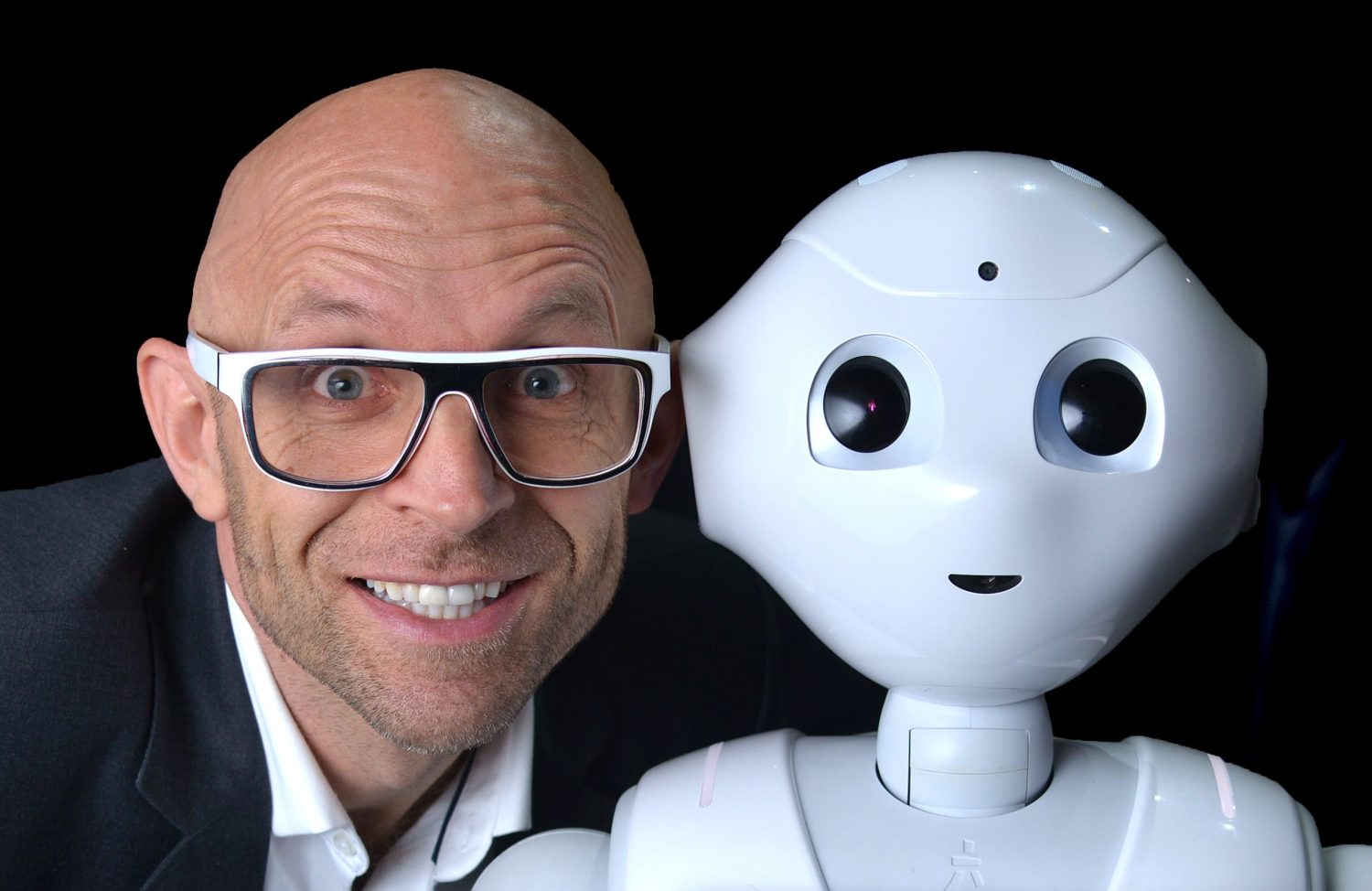

Jason Bradbury: 30 Days of AI

Jason is going to tell you all about his ‘30 Days of AI’, where he entrusted his every daily decision to artificial intelligence - for an entire month. In this fascinating experiment, he explores the potential benefits and risks of the machine learning revolution that is poised to affect how all of us live and work.

Through the examination of this thought-provoking experience, Jason illuminates the intriguing results of everything from mundane tasks - meal planning and workouts - to ambitious pursuits like creating a profitable side business or achieving financial independence – all seen through the prism of deep learning and Artificial Intelligence services.

Jason has been a student of AI for the last fifteen years. He’s interviewed AI researchers in Japan and Silicon Valley and at IBM’s New England campus, with a particular interest in the use of machine learning and robotics – including helping to create and train a robot to perform live stand-up comedy.

Drawing from his experience as a leading tech authority and his personal journey to balance work and life, Jason will offer insightful perspectives on the future of technology, its implications for leadership and business strategy along with the ethical and philosophical implications of the new age of AI.

Jason Bradbury

As a prominent tech specialist in the UK, Jason is a familiar face to many. He is known as a charismatic and inventive technology expert, former host of The Gadget Show and renowned public speaker.

Jason has filmed all over the world and his success on networks including BBC One, Channel 4, ITV, Discovery and Channel 5, and social platforms, have allowed him to diversify his career. He is the successful author of the Dot Robot techno thriller book series for young readers, published by Penguin Random House. As an entrepreneur, he founded a technology product consultancy with a focus on content ideation and creation, collaborating with an impressive roster of clients such as Maplin, Disney and Intel. During the 2020 pandemic Jason authored and directed the online video course, 'Talk', which now includes in-person workshops, aimed at honing public speaking proficiency, enhancing personal confidence, and refining business communication skills for company leaders and professionals.

Jason's commitment to making technology accessible and exciting has led him to speak at numerous conferences, collaborate with prestigious educational organisations, and inspire countless individuals to explore the world of technology.

- Robeco

-

Asia: a-once-in-a-decade opportunity

How can UK investors unlock the value potential whilst avoiding “value traps” to capture this once-in-a-decade opportunity in Asia? With many negatives reflected in valuations, Asia is cheap absolutely and relatively. Last time Asia was this cheap, fiscal and monetary policy was a lot weaker, yet subsequent market out-performance was dramatic. ASEAN is in the sweet spot: supply chain diversification benefits ASEAN as suppliers of materials, receivers of capex and consumers. Markets such as Korea & Taiwan carry the strong prospects of a semiconductor recovery against low valuations. India feels expensive but is becoming more attractive for its structural growth opportunities. In his presentation, Josh Crabb, Head of Asia Pacific Equities and Portfolio Manager will address how to navigate these investment opportunities.

Joshua Crabb

Lead Portfolio Manager and Head of Asia Pacific Equities

Joshua Crabb is Lead Portfolio Manager and Head of Asia Pacific Equities. Before joining Robeco in 2018, Joshua was Head of Asian Equities at Old Mutual and Portfolio Manager at BlackRock and Prudential in Hong Kong. He started his career in the investment industry as Sector Analyst at BT Financial Group in 1996. Joshua holds a Bachelor's with Honors in Finance from the University of Western Australia and he is a CFA® charterholder.

Phillip Davey

Sales Manager

Phillip Davey is a Sales Manager in Robeco’s UK Wholesale team. He joined Robeco in 2021 covering discretionary, strategic partner & family office relationships across London and the Channel Islands. Previously he was part of the UK Sales team at J.P. Morgan and Columbia Threadneedle.

T: + 44 (0)7834 998356

E: p.davey@robeco.com

Ben Rowley

Sales Manager

Ben Rowley is a Sales Manager in Robeco’s UK Wholesale team, covering discretionary & strategic partner relationships in London and across the UK. Ben joined Robeco in 2021, previously he was a senior member of the UK Sales team at Amundi, Pioneer Investments and Legg Mason.

T: + 44 (0)7891 660298

E: b.rowley@robeco.com

- PGIM Investments

-

Selectively embracing risk in emerging markets debt

Headwinds in the emerging market debt arena continue to subside. Still, even though attractive opportunities should become more apparent as monetary policy becomes less restrictive, indiscriminate emerging market exposure is likely to invite frustration against a volatile backdrop. Cathy Hepworth, Head of PGIM Fixed Income's Emerging Markets Debt Team and Portfolio Manager of the PGIM Emerging Market Total Return Bond Fund, will highlight why she believes a flexible, go-anywhere approach is the key to isolating alpha opportunities and avoiding potential pitfalls. Drawing on 37 years of experience, she will share insights from her team’s in-depth research across the emerging market spectrum.

Cathy Hepworth

Head of Emerging Markets Debt Team, PGIM Fixed Income

Cathy L. Hepworth, CFA, is a Managing Director and Head of PGIM Fixed Income's Emerging Markets Debt Team. Cathy co-founded the firm's emerging markets debt management effort in 1995. Previously, Cathy was an analyst in the credit unit group of the firm’s Capital Management Group, focusing on various sovereign, financial and corporate sectors. Prior to joining the firm in 1989, she held analyst positions at Bankers Trust, Merrill Lynch, and Golembe Associates. Cathy received a BSFS from Georgetown University, School of Foreign Service. She holds the Chartered Financial Analyst (CFA) designation.

Robert Hall

Head of UK Wholesale

Robert Hall, Head of UK Wholesale at PGIM Investments, leads the build-out of PGIM’s UK business in the wholesale channel. He also partners with the head of global financial institutions strategy to grow relationships with global banks in London. Before joining PGIM, Robert was a founding member of the UK Wholesale Sales team at Natixis Investment Managers, starting the business from scratch, forming partnerships with key UK fund buyers, and growing the brand. He worked at Natixis for 11 years.

M: +44 (0)7771 313468

E: robert.hall@pgim.com

Alastair Warren

UK Sales Manager

Alastair Warren, CAIA, is a UK Sales Manager for PGIM Investments. Alastair is responsible for fund distribution and relationship management across global financial intermediaries in the UK, Ireland and the Channel Islands. Prior to joining PGIM Investments in 2019, he worked for M&G Investments as a Client Relationship Manager. Within his role, he focused on sales and relationship management across global financial institutions, discretionary fund managers, and family offices in the UK/Channel Islands.

M: +44 (0)7866 155150

E: alastair.warren@pgim.com

- DoubleLine

-

DoubleLine – Maximizing your IG exposure through offering a higher yield per unit of duration

With 100+ professionals looking at this asset class, DoubleLine have constructed a flexible portfolio to maximise your IG exposure. The strategy is both defensive but also has the ability to invest across a broader range of fixed income sectors than most – improving the potential reward for the risk taken. Many players within this space tend to have larger exposures to corporate credit, whilst DoubleLine strive to be different and specialise in many other fixed income sectors (mortgages, ABS, Loans, EMD), resulting in a more genuinely diversified exposure and alpha opportunities.

Jeffrey J. Sherman

Deputy Chief Investment Officer

Jeffrey Sherman oversees and administers DoubleLine’s Investment Management sub-committee coordinating and implementing policies and processes across the investment teams. He also serves as lead portfolio manager for multi-sector and derivative-based strategies. He is a member of DoubleLine’s Executive Management and Fixed Income Asset Allocation Committees. Jeffrey Sherman is famous for his podcast, The Sherman Show (named as one of the “10 Must-Listen Podcasts” by Business Insider) and for founding DoubleLine, alongside CIO Jeffrey Gundlach (one of Bloomberg’s 2016, 2015 & 2012 “50 Most Influential”).

Edward Higgin

Partner, Harrington Cooper

Edward Higgin joined Harrington Cooper in November 2007. He is responsible for managing the implementation of the firm’s European-wide sales strategies and is a key member of the sales team, covering the UK, Ireland and Nordic regions. Prior to joining Harrington Cooper in 2007, Edward’s career was in advertising, working with some of the largest brands in the industry such as Proctor & Gamble.

T: +44 (0)20 7043 0503

E: ehiggin@harringtoncooper.com

Kirstin Gordon

Sales Manager and Business Development, Harrington Cooper

Prior to joining Harrington Cooper in September 2020, Kirstin Gordon worked at Schroders HK within the China Business Team. She holds a BA in History from Durham University and has attained the Investment Management Certificate (IMC). She is fluent in English, Cantonese and Mandarin.

T: +44 (0)20 7043 0500

E: kgordon@harringtoncooper.com

- Brown Advisory

-

The Intersection of Value Investing and Sustainability

Large swathes of the value sector have often been overlooked by sustainable investors as exclusionary strategies have typically been the ESG tool of choice. However, modern investors are demanding both a more nuanced approach, and solutions which can help mitigate the quality growth tilt within portfolios. Brown Advisory will discuss how they have approached building a US Sustainable Value strategy which utilises sustainable research to add informational advantage and drive performance, as well positive ESG outcomes. They will also consider how robust engagement can be beneficial to a company’s ESG trajectory – and help solve some of our thorniest sustainability challenges.

Michael Poggi

Portfolio Manager

Mike Poggi, CFA, is the Portfolio Manager for the Large-Cap Sustainable Value Strategy. He joined Brown Advisory in 2003 as an equity research analyst and has covered multiple sectors and industries with a primary focus on value companies across the market cap spectrum. For the past 13 years, Mike has also been dedicated to the Small-Cap Fundamental Value strategy as an associate portfolio manager while covering the industrial, material and energy sectors.

Katherine Kroll

Director of Equity ESG Research and Strategy

Katherine Kroll is the Director of Equity ESG Research and Strategy. She is responsible for ESG integration, adoption and research across Brown Advisory’s institutional equity investment strategies. Additionally, she leads the ESG engagement strategy and supports the expansion of sustainable investment solutions at Brown Advisory. Previously, Katherine was an Investment Specialist for the Large-Cap Sustainable Growth Strategy and a Senior Institutional Sustainable Investing Specialist. She was recognized as SRI’s “30 Under 30” sustainable investing professionals and was a leader of Women Investing for a Sustainable Economy (WISE). Prior to joining Brown Advisory, Katherine led the shareholder advocacy efforts for Green Century Capital Management.

Emma Jewkes

UK Sales Director

Emma Jewkes manages UK strategic partnerships as part of the business development team for Brown Advisory’s international business. Prior to joining Brown Advisory in November 2018, Emma worked at GAM as a client manager, looking after relationships with wealth managers, IFAs and platforms. Previous to this, Emma spent three years at Man Group, working across sales and marketing. Emma has a BA (Hons) from Kings College London and is a holder of the IMC.

T: +44 (0)20 7399 4378

E: ejewkes@brownadvisory.com

- Pictet Asset Management

-

Investing in environmental opportunities in China

Pictet Asset Management, a pioneer and global leader in thematic investing, will present their newest thematic strategy – Pictet-China Environmental Opportunities. This is the world’s first Article 9 SFDR impact fund that focuses on investing in the environmental themes in China. Yi Du, Senior Investment Manager, will speak about the key rationales and approach to investing with a positive impact in China’s fast-growing, multi-trillion environmental solutions market.

Yi Du

Senior Investment Manager

Yi Du joined Pictet Asset Management in 2018. He is a Senior Investment Manager in the Thematic Equities Team. Before joining Pictet, Yi worked in the Global Equity Research team of J.P. Morgan in Hong Kong covering utilities and environmental sectors in Asia. Prior to that, he worked in the Investment Banking team at Barclays in Hong Kong. Yi holds an MSc in Financial Economics with distinction from the University of Oxford. Yi is a Chartered Financial Analyst (CFA) charterholder.

Daniel Franklin

Head of Wholesale UK & Ireland

Dan Franklin joined Pictet Asset Management as Head of Wholesale UK in September 2017. Based in London, Dan focuses on developing the Wholesale business in London & the Channel Islands. Prior to joining Pictet Asset Management, Dan was a Business Development Director at Legg Mason for nearly 6 years. Dan graduated with a BA in History & American Studies from Middlesex University and holds the Investment Management Certificate (IMC).

T: +44 (0)20 7847 6432

M: +44 (0)7776 254956

E: dfranklin@pictet.com

Yi Shi

Client Portfolio Manager

Yi Shi joined Pictet Asset Management in 2022 as a Client Portfolio Manager in the Thematic Equities team. Prior to Pictet, Shi worked for Royal Bank of Canada in their wealth management business advancing ESG integration into equity investments, advisory, and research. Shi received a BA in Physics and a BS in Society and Environment from the University of California, Berkeley. He also received a Master of Environmental Management from Yale University’s School of the Environment and an MBA in Funds Management from the University of Toronto, Rotman School of Management.

T: +41 58 323 4283

M: +41 79 693 5259

E: yshi@pictet.com

- Allianz Global Investors

-

Trade Finance – an attractive client portfolio diversifier

Supply chain strains, geopolitical tensions and a scaling back of bank funding are spurring demand for trade finance. Investors can benefit from the potential for attractive returns and the short duration of the asset class. Join David Newman and Martin Opfermann as they explain what trade finance is, how it works and discuss why it could be an attractive option for investors in the current market.

David Newman

CIO Global High Yield

David Newman is a CIO within Allianz Global Investors’ Fixed Income team. He co-manages the trade finance strategy and he spearheaded AllianzGI’s approach to trade finance. David also manages traditional Global High Yield, Emerging Market Corporate and Global Multi Asset Credit portfolios and has been responsible for these strategies since inception. Previously, he was Managing Director, Head of Fixed Income Credit Research and Co-Head Credit Trading at Citigroup. Prior to that, David was Head of High Yield Credit Research at UBS. David has 35 years of investment experience.

Martin Opfermann

Senior Portfolio Manager

Martin Opfermann heads up the Trade Finance Team and co-manages the strategy with David Newman. He designed the Allianz Working Capital Fund (ALWOCA) and worked on its launch. Martin joined Allianz Global Investors in 2017 from Allianz Investment Management SE, where he was Head of Credit. Since 2009, he spearheaded Allianz’s strategic shift into private markets. Prior to this, Martin worked in the Fixed Income team of Allianz Lebensversicherungs-AG. Martin has 21 years of investment experience.

Matthew Couzens

Head of UK Wholesale Distribution

Matthew Couzens joined Allianz Global Investors in 2016 and has responsibility for relationships with London-based wealth managers, private client stockbrokers and multi-managers. Matthew has 18 years investment sales experience and has previously worked with Canada Life Investments, Russell Investments and L&G.

T: +44 (0)7701 003973

E: matthew.couzens@allianzgi.com

- First Eagle Investments

-

The Small Idea: Opportunities in US Small Cap

Bill Hench will discuss how he and his team strive to exploit inefficiencies in the small and micro-cap segment of the US market. He will explain how the team seek to invest in companies with a clearly identified issue and a clear catalyst to return to normalised earnings, an approach successfully employed over multiple decades and cycles.

Bill Hench

Head of Small Cap Team & Portfolio Manager

Bill Hench is Head of the Small Cap team and Portfolio Manager of First Eagle’s US Small Cap Opportunity Fund. Prior to joining First Eagle in April 2021, Bill was portfolio manager of the Small Cap Opportunistic Value strategy at Royce Investment Partners, where he worked for 18 years. Before that, he spent 10 years in the institutional equity business in Boston and New York, most recently with J.P. Morgan. He began his professional career as a CPA with Coopers and Lybrand. Bill earned a bachelor's degree from Adelphi University.

Akash Purohit

Account Manager

Akash Purohit is an Account Manager based in London responsible for covering non-US institutional clients and UK wealth. Akash leads the firm’s London office and is also Co-Lead of First Eagle’s Climate Council. Prior to joining the firm in October 2017, Akash worked in the investment consulting team at Aon Hewitt. He is a Fellow of the Institute and Faculty of Actuaries.

T: +44 (0)20 3608 8193

E: akash.purohit@firsteagle.com

Elliott Ojuri

Analyst

Elliott Ojuri is an analyst, responsible for supporting institutional and international wealth management clients. Prior to joining First Eagle in March 2023, Elliott was a senior analyst in the Equity Syndicate Execution team at Goldman Sachs, where he worked closely with the equity syndicate desk to execute equity transactions. He previously held internships at Goldman Sachs and Deloitte. Elliott earned a BSc in international business from the University of Leeds.

- Coronation Fund Managers

-

End of ‘free money’ to bring emerging markets back in vogue

The investment opportunity in emerging markets is very different from developed markets, yet they are assessed in the same way – resulting in underrepresentation in most global portfolios. With thousands of businesses to pick from in diverse and complicated jurisdictions, it takes an astute investor to find the best risk-adjusted long-term opportunities. Which businesses can adapt to change and adversity? How will they grow and what are they likely to earn in 5 or 10 years? Most importantly, at what price should we own them? Coronation Fund Managers is based in an emerging market and uniquely placed to understand the complexities and curveballs and identify a portfolio of the best EM opportunities with courage and conviction.

Suhail Suleman

Portfolio Manager

Suhail Suleman, CFA, is a portfolio manager, managing various strategies within the Global Emerging Markets investment unit. He joined Coronation in 2007 and has 20 years’ investment experience. Prior to joining Coronation in 2007, he worked at Futuregrowth Asset Management and Oasis with research and portfolio management roles in various asset classes.

Kirshni Totaram

Global Head of Institutional Business

Kirshni Totaram is one of the senior executives at Coronation and has been with the company for more than 20 years. She is part of the executive committee and has key responsibility for the global institutional business and product development. Prior to this at Coronation, she was part of the fixed income investment team and managed the Coronation Property Equity Fund. Kirshni is a qualified actuary and a CFA charterholder.

T: +27 21 680 2043

M: +27 82 895 5694

E: ktotaram@coronation.com

Sean Morris

Lead Client Service Fund Manager

Sean Morris is Lead Fund Manager for South Africa within the Global Institutional Business team. He joined Coronation in August 2002 and he has more than 28 years’ experience in financial services. Sean’s career in the industry started at Alexander Forbes, where he worked in both the Negotiated Benefits Consulting and Consultants and Actuaries divisions. Sean is a Certified Financial Planner and has a Bachelor of Commerce degree.

T: +27 21 680 2012

M: +27 83 441 1111

E: smorris@coronation.com

Downloads

Information

NGF International was devised and organised by Infusion Events. We will be available throughout the event and we will be happy to help with any queries you may have. Please come and find us at the registration desk or phone us on one of the following mobile numbers:

Sally Doyle 07881 957350

Sarah Ford 07702 331487

Wifi

Should you wish to catch up with the office during your breaks, we have arranged a complimentary and secure wifi connection.

To access the secure connection, please locate the network ‘NGF International’ and use the password: Infusion2024!

Transport

We recommend the following reliable car service: