Programme

| Time | Session | Location |

|---|---|---|

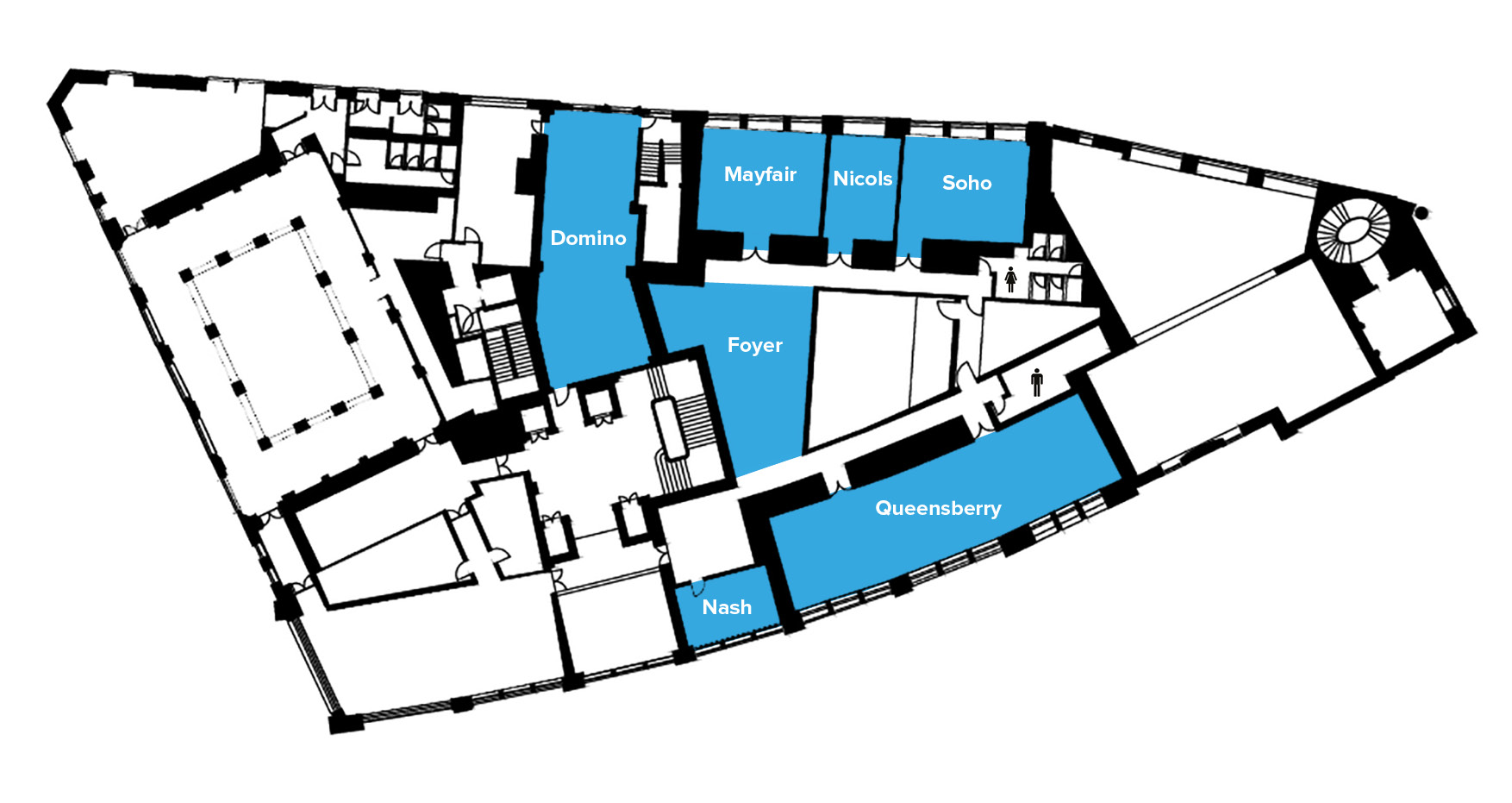

| 08:30 - 09:00 | Registration | Foyer → |

| 09:00 - 09:45 | Welcome & Keynote Address → | Queensberry → |

| 09:50 - 10:30 | BlackRock → | Nash → |

| 10:35 - 11:15 | BNY Mellon Investment Management → | Nash → |

| 11:15 - 11:45 | Coffee | Foyer → |

| 11:45 - 12:25 | Fidelity International → | Nicols → |

| 12:25 - 13:05 | Janus Henderson Investors → | Nicols → |

| 13:05 - 14:20 | Lunch: Ninety One | Queensberry → |

| 14:20 - 15:00 | M&G Investments → | Mayfair → |

| 15:00 - 15:40 | Artemis Fund Managers → | Mayfair → |

| 15:40 - 16:10 | Tea | Foyer → |

| 16:10 - 16:50 | Ninety One → | Soho → |

| 16:50 - 17:30 | Schroders → | Soho → |

| 17:30 | Drinks reception | Domino → |

Speakers

- Keynote address

-

Investing in the 21st Century Brain

‘Investment’ in the brain can be viewed in two ways: personal development and professional profit. We all have a personal interest in the brain, since it is the basis of our unique minds. The wonderful thing about being a human being is that although we are born with a full complement of brain cells, it is the growth of connections between the cells that accounts for the growth of the brain after birth. These connections reflect the unique sequence, a life-story, of individual experiences and interactions with the outside world: a phenomenon known as ‘plasticity’ that leads to the personalisation of the physical brain, amounting to a ‘mind’. Given the unprecedented challenges posed by the digital world to thinking, emotions and well-being, we need to devise the best ways for optimising fulfilment of each individual’s potential, as well evaluating the best possible investments arising from digital technologies and AI. The other significant factor for the well being of the 21st Century brain, and indeed in the opportunity for high return investment, is the increase in prevalence of Alzheimer’s Disease. The global market for AD treatment will more than double in value from $4.9 billion in 2013, to reach an estimated $13.3 billion in 2023. However, the challenge is to devise a treatment that tackles not the consequence of neurodegeneration i.e., amyloid plaques, but the actual cause. We shall explore a disruptive approach based on the pivotal mechanism of degeneration, leading to a possible pre-symptomatic lateral flow test for Alzheimer’s as well as a first-in-class therapeutic with proven efficacy in a living animal model. The combination of a presymptomatic screen coupled with an drug treatment that halted cell loss, would amount to an effective ‘cure’. This would surely be a great investment, both on a personal as well as a professional level!

Baroness Susan Greenfield

CBE, FRCP (Hon)

Baroness Greenfield, Founder and CEO of Neuro-Bio Ltd is a neuroscientist, writer and broadcaster. She has published over 200 papers in peer-reviewed journals, based mainly at Oxford University but has held research fellowships at the College de France Paris, NYU Medical Center New York and Melbourne University. She holds 32 honorary degrees from UK and foreign universities, has received numerous honours including the Legion d’Honneur from the French Government, an Honorary Fellowship from the Royal College of Physicians, The American Academy of Achievement Golden Plate Award, and The Australian Medical Research Society Medal. She is also a Fellow of the Royal Society of Edinburgh.

- BlackRock

-

UK Absolute Alpha: built for today’s market

Uncertainty prevails, monetary regime change is taking place alongside an increasingly challenging economic backdrop. A difficult and volatile environment for beta but one which presents a rich hunting ground for a long/short investor.

In this session, Richard Wingfield, Portfolio Manager on BlackRock’s UK Long/Short strategies, will discuss his latest market outlook, outline why he believes the next five years will look materially different to the last and why now is the time for Absolute Alpha, a product that benefits from dispersion designed to deliver positive returns regardless of market conditions.

Richard Wingfield

Portfolio Manager

Richard Wingfield, Director and Portfolio Manager, is a member of the UK Equity team within the Fundamental Equity division of BlackRock's Portfolio Management Group. He is responsible for managing Long/Short UK Equity portfolios and is Head of Research for the UK Equity Team, with research responsibility for covering the consumer sector. Richard’s service with the firm dates back to 2011, following a first class MA (Hons) degree in Economics from Edinburgh University.

Andrew Norwell

Director

Andrew Norwell is a member of the Manager Research Team within the UK iShares and Wealth business. The team are responsible for the coverage of fund selectors across Private Banks, Wealth Managers and Advisors in the UK. This includes the distribution of BlackRock's active, alternative and index strategies.

E: andrew.norwell@blackrock.com

Jamie Sinclair

Head of Manager Research Coverage

Jamie Sinclair is Head of the Manager Research Team within the UK iShares and Wealth business. He leads the team responsible for the coverage of fund selectors across Private Banks, Wealth Managers and Advisors in the UK. This includes the distribution of BlackRock's active, alternative and index strategies.

E: jamie.sinclair@blackrock.com

- BNY Mellon Investment Management

-

Sustainable opportunities in Continental Europe

How emerging regulation and public sentiment in continental Europe offer exciting long term prospects for companies that provide solutions to sustainable challenges, as well as those that are on verifiable journey of transition or balance well the needs of all stakeholders.

Paul Markham

Portfolio Manager, Head of Global Opportunities team

Paul Markham is one of Newton’s most experienced equity investors, managing a selection of global and regional equity mandates. In addition to portfolio management responsibilities, Paul helps shape Newton’s global thematic process as a co-chair of the ‘healthy demand’ group, which establishes the thematic backdrop to set the scene for potential investment opportunities across healthcare and related areas. He has been a member of the team responsible for managing global equity portfolios since June 2001. Prior to joining Newton in 1998, Paul worked in capital markets for Morgan Stanley. Paul holds a BA (Hons) in French and Spanish from the University of Sheffield.

Michael Beveridge

Head of UK Intermediary Distribution

Michael Beveridge currently leads the UK Wholesale Distribution team of 15 individuals covering all wholesale channels. He works closely with other functional areas across the business and the 8 investment boutiques. Michael has over 27 years’ experience in financial services, most recently as Head of UK Wholesale at Aberdeen Standard Investments. Michael joined BNY Mellon in July 2019.

M: 07788 362800

E: michael.beveridge@bnymellon.com

Nick Thiem

Head of Wealth Managers & Private Banks

Nick Thiem joined BNY Mellon in 2018 with responsibility of working with the BNY Mellon boutique investment partners to distribute their capabilities to Wealth Managers and Private Banks in the UK. Nick has over 24 years’ experience in the Investment Management industry having previously worked in senior roles Coupland Cardiff, Aberdeen Asset Management/SWIP and Gartmore.

M: 07825 341073

E: nicholas.thiem@bnymellon.com

- Fidelity International

-

Redrawing the emerging markets complex

As more investors consider a standalone allocation to China - and its weighting in traditional indices continues to grow - EM ex China is emerging as its own unique asset class. What’s more, a rich pool of entrepreneurial talent, coupled with a strong demographic profile, provides compelling growth opportunities for the future.

In this session, portfolio managers Zoltan Palfi and Robert Pearce will introduce the Fidelity Sustainable Emerging Markets ex China strategy. Leveraging the insights of Fidelity’s large EM research team, they will discuss how they capture the most attractive opportunities across these diverse markets through a portfolio of 40-60 high growth companies, with strong sustainability characteristics.

Zoltan Palfi

Co-Portfolio Manager

Zoltan Palfi joined Fidelity in 2013 as an Equity Analyst, covering EMEA and Latin America Energy stocks, before rotating to cover Financials in 2016. Since 2019, Zoltan’s responsibilities have expanded to encompass cross-asset class research. Zoltan is currently the Lead Portfolio Manager of Fidelity’s EMEA strategy, an Assistant Portfolio Manager of the Emerging Markets strategy and a Co-Portfolio Manager of the Sustainable EM ex China strategy. Zoltan started his investment career in 2007 and from 2007 to 2013 was a sell side analyst at UBS and Credit Suisse. Zoltan holds a MSc Finance from Corvinus University of Budapest and is a CFA Charterholder.

Robert Pearce

Co-Portfolio Manager

Robert Pearce joined Fidelity in 2014 as an Equity Analyst, covering EMEA Financials. In December 2016, he rotated to cover the Latin America Consumer sector, which he continues to cover today. Rob is a Co-Portfolio Manager of Fidelity’s Latin America, Global EM Consumer and Sustainable EM ex China strategies. Rob holds a BA (Hons) Economics and Management from Cambridge University and is a CFA Charterholder.

Paul Heselden

Sales Director

Paul Heselden is a Sales Director in the UK and has been working at Fidelity International for 24 years. He is responsible for distribution in the wholesale UK market – predominantly for Discretionary Wealth Managers, Private Banks, Family Offices and Multi Managers in London. Prior to joining Fidelity, Paul studied International Financial & Legal Studies at Sheffield Hallam University.

M: 07738 312652

E: paul.heselden@fil.com

- Janus Henderson Investors

-

Global Property Equities: Navigating the year ahead with durable income streams

2022 offered very few hiding places and property equities were no exception. In fact, listed real estate fared worse than most. Has this created an attractive entry point relative to historical valuations? Dependable income streams, paired with vastly improved debt structuring in the years post the Global Financial Crisis, may position REITs as favourable options in a period of cyclical weakness. Guy Barnard, Co-Head of Janus Henderson's Global Property Equities team discusses these attributes and which areas of the market are best placed to continue to deliver earnings and dividend growth, even as economies slow.

Guy Barnard

Co-Head of Global Property Equities, Portfolio Manager

Guy Barnard is Co-Head of Global Property Equities at Janus Henderson Investors, a position he has held since 2014. He is also a Portfolio Manager responsible for managing the Global Real Estate Equity and Global Property Equity strategies. Guy joined Henderson in 2006 as an analyst and became a fund manager in 2008 and deputy head of Global Property Equities in 2012. Before Henderson, he worked for UBS in financial control. Guy holds a first class BSc degree (Hons) in mathematics and management from Loughborough University. He holds the Chartered Financial Analyst designation and has 19 years of financial industry experience.

Matthew Frost

Director

Matthew Frost joined Henderson as part of the firm’s acquisition of Gartmore in 2011. In his current role, Matthew is responsible for discretionary and advisory client relationships in the London region. He joined Gartmore in 2000 and worked in a number of roles with the UK retail sales team before being promoted to discretionary account director in 2010. Matthew began his career with Westpac in 1990. Matthew has 33 years of financial industry experience.

M: 07946 182038

E: Matthew.Frost@janushenderson.com

Ben Tucker

Associate Director

Ben Tucker has carried out the role as Associate Director on the UK Retail Sales team at Janus Henderson Investors since 2016. He is responsible for discretionary and advisory client relationships in the London and Southern England regions. Prior to this, Ben spent time at the firm’s Chicago office, where he managed the internal sales team from 2012 to 2016. He started his career at Janus in 2010 working on the London sales team and has 13 years of financial industry experience.

M: 07984 658786

E: Ben.Tucker@janushenderson.com

- M&G Investments

-

M&G Asian Equity programme: stock picking, risk pricing and thinking like a business owner

The session will draw on David Perrett’s deep experience in Asian equity markets and showcase why a team focused coverage approach, institutional mindset and differentiated risk navigation lens make for a compelling proposition. He will explore the trade-off between stock picking and risk navigation and how the process translates into seeking long-term returns for clients. He will expand on the concept of “Added Value Shareholdership” and show how discipline in this area alongside thinking like a business owner, can lead to superior risk pricing. David will also comment on the investability of Chinese equities and highlight current areas of focus given continued valuation dislocations in this area.

David Perrett

Co-Head of Asian Investment

David Perrett joined M&G as Co-Head of Asian Investment with 28 years of investment experience and was appointed to the management teams of the Japan and wider Asian strategies. David was previously with Oxford-based Port Meadow Capital Management, a boutique investment firm he co-founded with Carl Vine in 2014. Prior to that, he was Managing Director and Senior Portfolio Manager with UBS, specialising in investing capital across Asia Pacific and was based in Hong Kong. David also served as Chief Investment Officer, Life and Institutional for Prudential Asset Management (Hong Kong), having begun his career with Prudential (London) in 1991.

Rupert Wooster

Sales Director

Rupert Wooster joined M&G in 1994, and has held various roles in wholesale distribution, including an ill-fated period in management from which he has now fully recovered. He spent 2022 telling people how "nauseatingly happy" he is in his current role of "on the road sales rep" and optimistically expects to continue employing this narrative for many years to come.

T: 020 3977 2636

E: rupert.wooster@mandg.com

Paul Faragher

Sales Director (London)

Paul Faragher joined M&G Investments in April 2021 as a Sales Director in London. Prior to this, he held a senior sales role for three years as Jupiter Asset Management. Previously Paul was at BNY Mellon for twelve years, the majority of which was spent as a Regional Investment Director, working with key advisory and discretionary clients across East Anglia and the South East. Paul holds the IMC and CFA Certificate in ESG Investing.

M: 07971 855178

E: paul.faragher@mandg.com

- Artemis Fund Managers

-

Is the US still the land of opportunity?

Artemis’ Adrian Brass believes we are at the tail end of an economic cycle, with the delayed impact of financial tightening about to take its toll. At the same time, major government spending programs aimed at rebuilding, reshoring or decarbonising America, are just starting to benefit sectors from infrastructure and semiconductors through to defence and utilities. This combination of great uncertainty and divergent fundamentals Adrian believes present a fruitful environment for the conviction stock picker. In his presentation, Adrian explains why the Artemis US Extended Alpha fund is a differentiated offering both in terms of holdings and scope.

Adrian Brass

Fund Manager

Adrian Brass manages Artemis’ US Extended Alpha long/short strategy alongside co-managers James Dudgeon and William Warren. He was the lead manager of Majedie Asset Management's US Equity fund and co-manager of its Global Equity and Global Focus funds from 2014. Prior to Majedie, Adrian was a fund manager at Fidelity, managing US equity funds including its America fund, for six years. He holds a bachelor of science degree in economics and politics from the University of Bristol and is a CFA charterholder. Adrian joined Artemis in 2022.

Adam Gent

Head of Intermediated Business

Adam Gent joined Artemis in August 2020 as Head of Intermediated Business with responsibility for wholesale sales channels across the UK and European markets. Adam began his career in asset management in 2000 at Thesis Asset Management as a discretionary wealth manager. In 2005 he moved to Henderson Global Investors as Southern Sales Manager before joining Legg Mason Global Asset Management in 2007. Adam then joined Allianz Global Investors in 2017.

M: 07714 415143

E: adam.gent@artemisfunds.com

Iain MacPherson

Sales Director, London and Ireland

Iain MacPherson joined Artemis in March 2021 as Sales Director and is responsible for intermediary sales covering central London and Ireland. Iain was previously with Comgest for three years building its UK wholesale business in the UK, Dublin and the Channel Islands. Before Comgest, Iain was Regional Investment Sales Manager for central London at Standard Life Investments, where he began his career in 2009 on its sales and distribution graduate programme.

M: 07919 176426

E: iain.macpherson@artemisfunds.com

- Ninety One

-

Ninety One Global Macro Alternative

While the significant reset in equity and fixed income markets over 2022 has resulted in more appealing prospective returns from here, investors still face a challenging environment from both a structural and cyclical perspective. Alex Holroyd-Jones, Portfolio Manager at Ninety One, will describe how the recently launched Global Macro Alternative Fund is well placed to navigate these challenges through the use of flexibility, breadth and the combination of cyclical and structural perspectives. Alex will also explain the role this liquid alternatives strategy can play in portfolios over the long-term.

Alex Holroyd-Jones

Portfolio Manager

Alex Holroyd-Jones is a portfolio manager in the Multi-Asset team at Ninety One. Alex’s research responsibilities include macro, fixed income and currency. Prior to joining the firm in 2013 he worked on the Crude Oil and Products finance desk at ConocoPhillips, with a focus on derivatives. Alex graduated from Loughborough University with a first class Bachelor of Science (Hons) degree in Business Economics and Finance. Alex is also a Chartered Financial Analyst (CFA®) Charterholder.

Rodger Kennedy

Director, Head of London Wealth

Rodger Kennedy is the Sales Director for London within the UK Client Group at Ninety One. He is responsible for distribution to discretionary wealth managers, stock brokers, multi managers and private banks. Prior to joining Ninety One in 2001, Rodger began his career in 1997 with Bell Lawrie in Edinburgh where he trained as a stockbroker. Rodger has passed the Registered Representatives exam from the Securities Institute and holds the IMC and FPC Qualifications.

M: 07740 503334

E: rodger.kennedy@ninetyone.com

Wil Jeffs

Sales Director, London Wealth

William Jeffs (Wil) is a Sales Director within the London Wealth team at Ninety One. He is responsible for assisting the distribution of Ninety One funds to discretionary wealth managers, multi manager and private banks in London. Prior to joining Ninety One, Wil began his career in 2010 as an investment manager at Brewin Dolphin. Wil has passed his CISI Level 7 Chartered Wealth Manager qualification and holds the CISI Diploma in Investment Advice (IAD).

M: 07796 958883

E: william.jeffs@ninetyone.com

- Schroders

-

An introduction to Schroders Sustainable Bond Fund in amongst a broader sustainable asset allocation strategy

Introducing the framework to assess sovereigns on sustainability grounds.

Marcus Jennings

Fixed Income Strategist

Marcus Jennings is a Fixed Income Strategist at Schroders. He joined Schroders in 2015 in the Economics team on the graduate scheme, and in 2017 Marcus joined the Global Fixed Income and Currency Team. He started his career in 2013 at RBC Wealth Management as a graduate trainee. Marcus has a Master in Finance and Economics from Warwick Business School, and a BSc in Economics from Southampton University. He is also a CFA Charterholder, has obtained the IMC & holds the Certificate in ESG Investing.

Samantha Gold

Head of London & Wealth

Samantha Gold was appointed Head of London and Wealth within the UK Intermediary Team in 2021 and manages the team responsible for client relationships across the London area. Having joined Schroders in 2000, she has 22 years of industry experience. Over this period, she has held a number of key positions within the UK Intermediary Team, including Head of Broker Liaison, Head of Business Development and Head of Intermediary Business Development, London.

E: Samantha.Gold@schroders.com

M: +44 (0)7770 496062

Emma Matthews

Sales Director

Emma Matthews is in the UK Intermediary Business Development team at Schroders, which involves maintaining relationships and supporting London based discretionary clients. Specifically, wealth managers, multi-managers, family offices and fund of hedge funds. She joined the team in 2014 after two years at Cazenove as an assistant portfolio manager, and prior to her current role, supported sales managers across London discretionary and South Africa.

E: Emma.Matthews@Schroders.com

T: +44 (0)20 7658 1363

Downloads

Information

The Next Generation Forum was devised and organised by Infusion Events. We will be available throughout the event and we will be happy to help with any queries you may have. Please come and find us at the registration desk or phone us on one of the following mobile numbers:

Sally Doyle 07881 957350

Sarah Ford 07702 331487

Wi-Fi

Should you wish to catch up with the office during your breaks, we have arranged a complimentary and secure Wi-Fi connection:

SSID: NGF23*

Password: 23FGN2023

Drinks Reception

A reminder that the Drinks Reception will commence at 17.30 in Domino, which is also on this floor of the hotel. Please refer to the floorplan section or we will be happy to direct you. Dress code remains Business Attire.

Transport

We recommend the following reliable car service: